Stocks plummet 26%, Rolex acquisition triggers chain reaction

Yesterday, everyone must have received the news " Rolex is invincible... ". Xinxuan wrote a related article, which has been read more than 50,000 times in 24 hours. However, yesterday was just a brief introduction to the background story, and after a day of market fermentation, I shared some of the latest information.

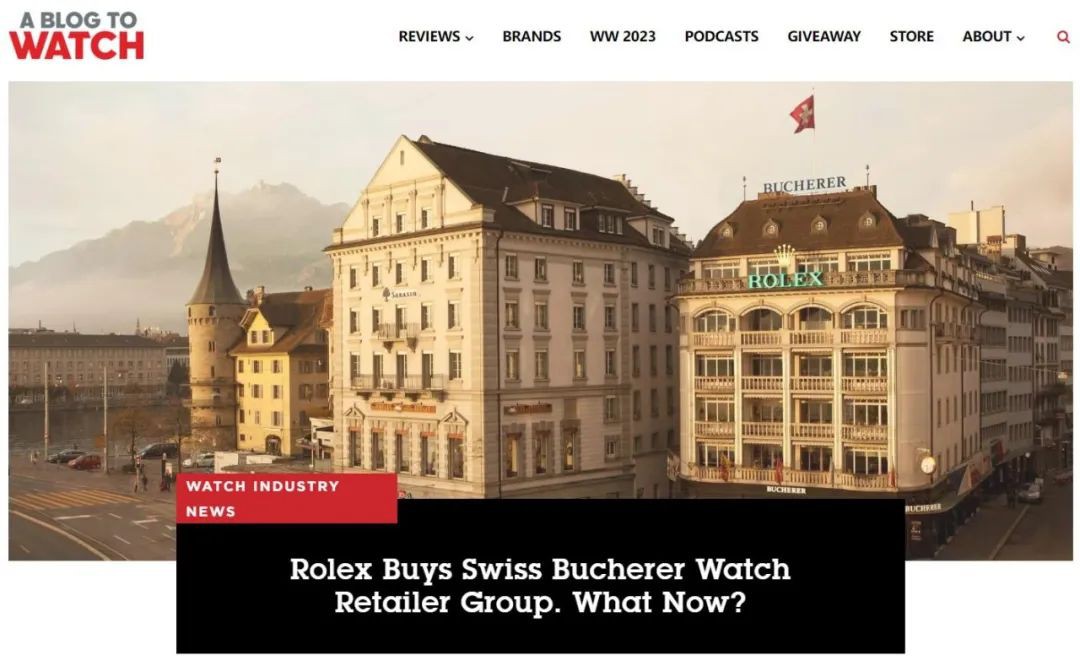

After Rolex acquired watch dealer Bucherer , the biggest impact is currently on another dealer, Watches of Switzerland. Its intraday stock price fell as much as 26%, and its final single-day drop was 21.42%. Bucherer's dealer peers are mainly Shengshi Group in mainland China (annual sales of 10 billion yuan +), Chow Tai Fook Group in Hong Kong (the group's total total is 88 billion yuan, of which the watch segment is 4.7 billion yuan), and The Hour Glass in Southeast Asia (RMB 7.3 billion), WOS in the UK (RMB 9.4 billion), Ahmed Seddiqi & Sons in the Middle East (RMB 2 billion+). In addition, Tourneau, the largest distributor in the United States, was acquired by Bucherer in 2018. Since the main stores of Bucherer in Switzerland and WOS in the UK are located in the European and American markets, the overlap rate between the two is the highest. So when the news of Rolex’s acquisition of watch dealer Bucherer was announced, there was widespread concern about the profitability of WOS in the future. Although Rolex officials have repeatedly emphasized in statements that Bucherer will retain its name and operate independently, and the existing management team and distribution agency relationships with other brands will not change. But investors don’t believe it and run faster than anyone else. The reason why they have fallen so much is that both Rolex and Bucherer are private companies, and their financial statements and business operations are not disclosed and supervised. However, Rolex's sales policy is very strong. Dealers are not free to purchase watches, and can only rely on Rolex to actively distribute them. In addition, the allocation amount each dealer gets and the amount of hot money in the market are completely hidden. Therefore, in theory, which dealer Rolex wants to make money and how much money it makes is exclusively controlled by Rolex.

Although Rolex previously had a self-operated store in Geneva, its remaining more than 2,000 stores around the world rely on dealers. Now that it has acquired Bucherer and has more than 50 stores, all of which are the core stores in the European and American markets with the best sales, I don’t know if Rolex can still maintain “a bowl of water.” In fact, only a few core executives and financial officers of Rolex and Bucherer can confirm this answer.

Second question, will Swiss regulators approve Rolex’s acquisition of Bucherer? At present, Rolex has only issued an announcement and has not completed substantive delivery. But according to my personal understanding, there is no strong obstacle to this transaction. First of all, Rolex is a local snake and a big taxpayer in the Swiss state of Geneva. They are all acquaintances in the parliament. They must have greeted them in advance, otherwise they would not make an official announcement. Secondly, Rolex and Bucherer are both local private companies in Switzerland and have no supervision. Finally, and most importantly. The Swiss government encourages mergers in the watch industry to form giant companies, and particularly supports domestic companies in doing so. The reason is very simple. The watch industry is industrialized production, and the larger the volume, the lower the cost. Switzerland's domestic market is pitifully small, and the watch industry is an important means for Switzerland to earn foreign exchange.

As early as the economic crisis in the 1930s, the Swiss government began to support major watch brands and manufacturers to form watchmaking associations, forming a national monopoly, and earning foreign exchange, which is a proper national tradition. For example, today's Swatch Group was actually the merger of two associations with state-owned assets background, SSIH and ASUAG.

Third, after the distributor Bucherer is acquired, where will the watch brand Carl F. Bucherer go?

At present, Rolex’s disclosure does not explicitly mention Carl F. Bucherer watches . However, citing ABTW news, it will still be bought by Rolex. The reason is that the Carl F. Bucherer brand itself is actually a brand launched by the dealer Bucherer in order to make profits. In its special tour guide sales model, Carl F. Bucherer’s sales commission will be higher. In the secondary market, the acceptance of Carl F. Bucherer watches is relatively low. If Rolex only bought Bucherer dealers but not Carl F. Bucherer watches, it would be even more difficult for the brand. The two are actually in a symbiotic relationship. At the same time, its owner Jorg Bucherer’s purpose is to cash out and leave, so how can he leave a useless thing behind?

Fourth, will it have any impact on our mainland Chinese market? It won't have any impact in the short term. Bucherer dealers do not have Rolex stores in mainland China, only Carl F. Bucherer watches are sold. And, in accordance with Rolex’s tradition of “forbearance”. Even if the sales distribution policy is really adjusted in the future, or Bucherer dealers enter mainland China, it will be at least 5-10 years away.

Fifth, this is also a comment that I find very interesting, coming from the foreign watch media ABTW. They said that Rolex had repeatedly emphasized in its official statement that "Rolex's purchase of Bucherer is in the best interests of Bucherer, its employees, and all brands represented by Bucherer." In other words, if another consortium acquires Bucherer, it is likely to be "reckless". For example, selling goods at low prices, information leakage... For example, LV MH is a French company, and Chow Tai Fook is from Hong Kong, China. Everyone should bear in mind that the Swiss are very, very united. They are very "exclusive" and don't want outsiders to get involved in their watchmaking industry.

The quartz crisis in the 1970s caused Omega and Longines to struggle, and they were almost sold to the Japanese consortium. In the end, it was the people from all walks of life in Switzerland who raised money, otherwise the brand would be lost. Although Rolex is a company that also aims to make money, its equity belongs to a charitable foundation. It takes both black and white in Geneva, Switzerland. In fact, it already shoulders certain social responsibilities. As the largest sales player in the watch industry and an important part of it, Rolex spent some money to acquire Bucherer to protect it from consortiums from other countries and maintain the long-term stability of the Swiss local watch industry. Maybe this is really a "protection method." . Just like Cao Cao's preference for widows, in that troubled world, orphans and widows were easily bullied and even killed. With Cao Cao, at least he can live comfortably and get effective protection. —END—